Non-EU worker migration surges in central and eastern Europe

Human capital Released April 10, 2024

Migrants from outside the bloc are slowly reversing years of brain drain in CEE countries

Read more

We collect data directly from companies & agencies who submit their data voluntarily to us. How do we gather so much? Over 18 years of being the industry leader with greenfield data speaks for itself.

Our team of in-house analysts collect data primarily from publicly available sources. We monitor thousands of media sources on a daily basis as well as all leading industry organisations and Investment Promotion Agencies. Each project identified is cross-referenced against multiple sources, with primary focus on direct company sources.

Search by country, industry, date and more to access data and reports of interest to you.

Using our data you can more effectively implement business or investment decisions to maximise your ROI.

Primarily sourced from publically available sources our team of analysts collate data to inject into our software. They collect data using the following sources;

Have another question? Looking for more detail? Check out our help hub, maybe an article or whitepaper we have released can help!

fDi Markets tracks crossborder investment in a new physical project or expansion of an existing investment which creates new jobs and capital investment. Joint ventures are only included where they lead to a new physical operation. Mergers & acquisitions (M&A) and other equity investments are not tracked. There is no minimum size for a project to be included.

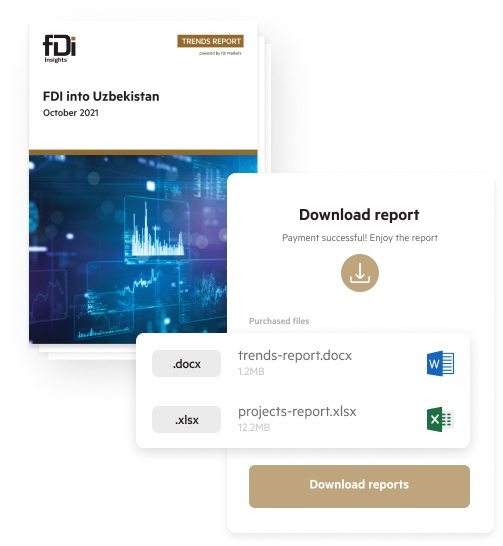

You can purchase data and reports online, click here to search for available reports.

Alternatively, if you require more in-depth analysis or regular access to continuous data please contact us to discuss the options.

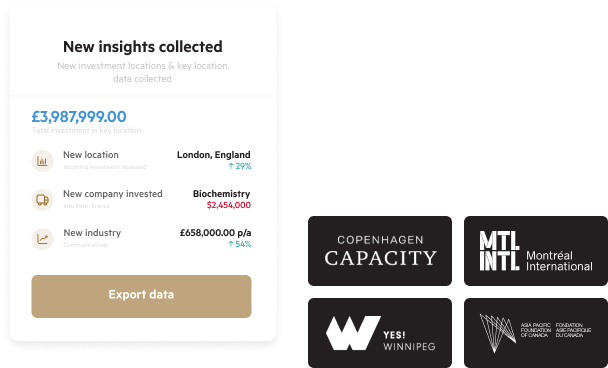

Data goes through a rigorous quality control process, before being published at the end of each month to Trends Analysis and reporting tools.

fDi Insights tracks information on capital investment and direct jobs associated with an FDI project.

As companies do not always release information on investment amount or job creation, a proprietary econometric model estimates the jobs and investment where the actual value is not known.

Each project tracked by fDi Insights is classified according to its cluster, sector, sub-sector and business activity, based on a proprietary industry classification system.

We have delivered 20,000 reports in over 90 countries around the world, and counting.

Backed by the most trusted financial organisation in the world.

We serve data to a wide range of audiences, including education.

Experts in FDI since 2001

Make informed global investment decisions and identify trends using our industry-leading FDI data through easy to digest downloadable reports.

Sign up to receive our free fDi Intelligence newsletter so that you stay current with the latest trends driving crossborder investment and get access to our free whitepapers including The fDi Report.

Description